do you pay property taxes on a leased car in ct

The registration equity and plate may be transferred from the leasing company to you with a letter of authorization from the leasing company. Leased and privately owned cars are subject to property taxes in connecticut.

Who Pays The Personal Property Tax On A Leased Car

If you terminate your lease it is very important that you provide the Tax Assessors with a return of plate receipt or a letter from your insurance company showing the vehicle cancelled from your.

. When you lease a vehicle the car dealer maintains ownership. But most of Connecticuts 71 independent fire departments do. This northern New Jersey county has effective property tax rates that are more than double the national average.

Connecticut car owners including leasing companies are liable for local property taxes. Individuals are not guaranteed privacy while using government computers and should therefore not. You must update DMV within 48 hours of any change of address.

When you rent a car the dealer always retains ownership. For example in Alexandria Virginia a car tax is 5 per 100 of the estimated value while in Fairfax County the assessment is 457 per 100. Yes you may take a credit against your 2016 Connecticut income tax liability for qualifying property tax payments you made to your Connecticut town or taxing district on your privately owned or leased motor vehicle or both.

All tax rules apply to leased vehicles. It will take an additional 48 hours after your payment has been processed to be cleared through Motor Vehicle Our online service will no longer support Internet Explorer after March 31st 2021. The owner of the vehicle iswas GMAC.

Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in your lease contract. If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hill can help you out. Vehicles cannot be registered if delinquent property tax or parking tickets are owed or if the registrant.

Most leasing companies though pass on the taxes to lessees. They pay the personal property taxes on the vehicle unless otherwise stated in your lease contract. This computer and the automated systems which run on it are monitored.

You pay personal property taxes on the vehicle unless otherwise stated in your lease. For a rented vehicle at the time of signing you must pay the 3 North Carolina car rental tax on the total rental. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name.

The countys average effective property tax rate is 346. 170 rows The local property tax is computed and issued by your local tax collector. To change your address with DMV please use the following link.

But yes unfortunately one way or the other you will still need to pay property taxes for a leased vehicle. If you do pay the personal property tax you can deduct it on your taxes if. Many districts especially those formed by owners or homeowners associations do not tax motor vehicles.

Some build the taxes into monthly lease payments as landlords build real estate taxes into monthly rent payments while others pay the tax and then bill the lessee for the tax payment explained Colchester tax. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. DMV will no longer accept paper tax releases beginning November 16 2015.

In New Jersey you can choose to pay sales tax in advance at the purchase price or the sum of the lease payments. In all cases the tax advisor charges the taxes to the dealer and the dealer pays. Unauthorized use of this computer is a violation of federal law and may subject you to civil and criminal penalties.

Alaska juneau only arkansas connecticut kentucky That means you owe taxes on only 10000 instead of 30000. The maximum credit allowed on your motor vehicle is 200 per return regardless of filing status. However the bill is mailed directly to the leasing company since leased cars are registered in the companys name.

You pay personal property taxes on the vehicle unless otherwise stated in your lease. This is very unusual. After receiving an estimate of his municipal property taxes Sergienko was informed by tax collector Enfield that his leased Honda would be taxed.

Do I pay taxes on my leased vehicle. Connecticut connecticut car owners including leasing companies are liable for local property taxes. Change of address - Moving within Connecticut What proof is required for a MV tax credit if my vehicle was.

You have accessed a United States Government computer. The most common method is to tax monthly lease payments at the local sales tax rate. State sales tax laws may change so the dealership where you rent the car determines how and when you pay sales tax.

When you rent a car the dealer always retains ownership. In most cases the agreement made between the dealer or leasing agency and the person leasing the vehicle will pass the cost of property taxes on to the lessee most frequently as. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or dealer.

This means you only pay tax on the part of the car you lease not the entire value of the car. A dealer who rents a vehicle retains ownership. For most connecticut municipalities the tax due date for the october 1st grand list bill is.

It takes 24 hours for the Plainville Revenue Office to receive and process online credit card payments. Sold Terminated my lease Totaled Donated Taxed in wrong town etc. Do You Pay Property Tax on Lease Car If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return.

If the lease agreement states that you are responsible for these taxes you will receive an invoice from the dealer. The Internal Revenue Service requires that these deductible ad valorem taxes be based on the value of the car and be levied by the state each year. If you do not register a motor vehicle but retain ownership you must annually file a declaration form with your assessor s between October 1 and November 1.

Pennsylvania Property Tax H R Block

Just Leased Lease Real Estate Search Property For Rent

Guide To Leasing A Car How It Works How Much It Costs

Who Pays The Personal Property Tax On A Leased Car

Who Pays The Personal Property Tax On A Leased Car

The States With The Lowest Car Tax The Motley Fool

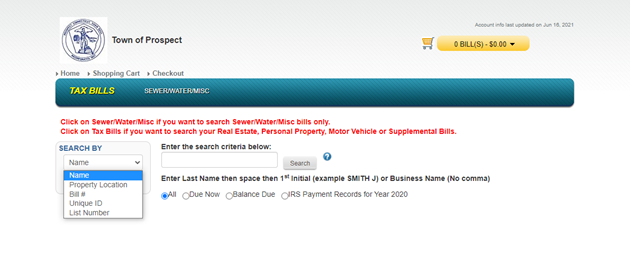

Office Of The Tax Collector City Of Hartford

Who Pays The Personal Property Tax On A Leased Car

Which U S States Charge Property Taxes For Cars Mansion Global

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars

Do You Have To Pay A Vehicle Tax Here S Some Good News The Motley Fool

7 On Your Side How To Avoid Car Lease Buy Out Rip Offs Abc7 New York

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Connecticut S Sales Tax On Cars

Who Pays The Personal Property Tax On A Leased Car

Property Tax California H R Block

What You Should Know About Leasing A Car In Ct Ct Sales Tax On Cars